1. Executive Summary

The FSA commissioned a survey via Ipsos UK’s online omnibus on use of CBD products. This survey was commissioned to gain an understanding of why CBD is used and what users would do if it were no longer available on the market. It also explored consumers’ understanding around regulation. Screening from a nationally representative starting sample of 1,968 adults aged 18-75 in England, Wales and Northern Ireland, there were 384 participants who reported using CBD in the past 12 months. Key findings include:

-

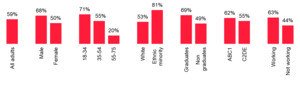

19% of adults aged 18-75 report having used products containing CBD in the past 12 months. Reported usage is much higher among 18-34 year olds (31%) compared to older adults (19% of 35-54s, 6% of 55-75s), as well as people from ethnic minority backgrounds (30% vs 17% from white ethnic groups). Usage is also slightly higher among men compared to women (20% vs 16%) and those in higher social class groups (ABC1) compared to lower social class groups (C2DE) (21% vs 16%).

-

Just over two in five users (44%) report that they first consumed CBD products in the past year.

-

Three in five users (59%) feel reliant on CBD products – with 28% feeling very reliant.

-

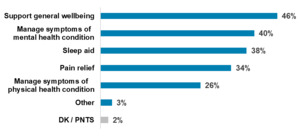

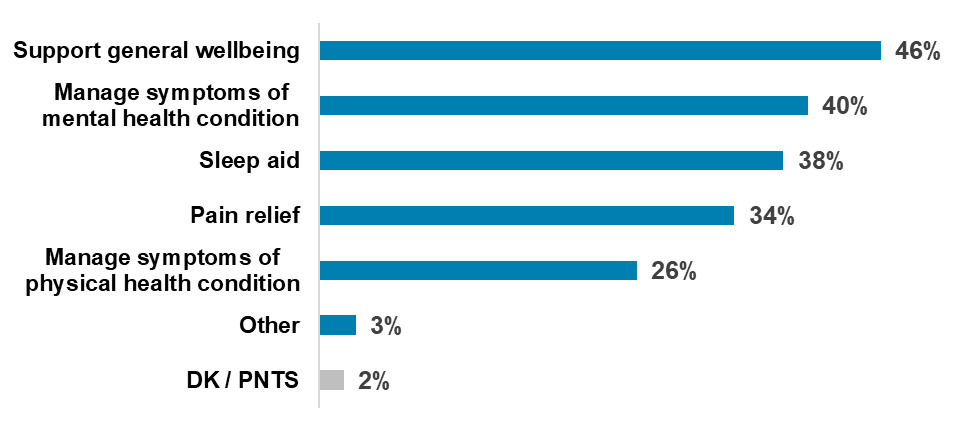

The most common reason for using CBD products is to support general wellbeing (46%), followed by managing mental health conditions (40%). Using CBD for pain relief (34%) and managing physical symptoms (26%) is less common among users – but those using CBD for these reasons are more likely to feel reliant.

-

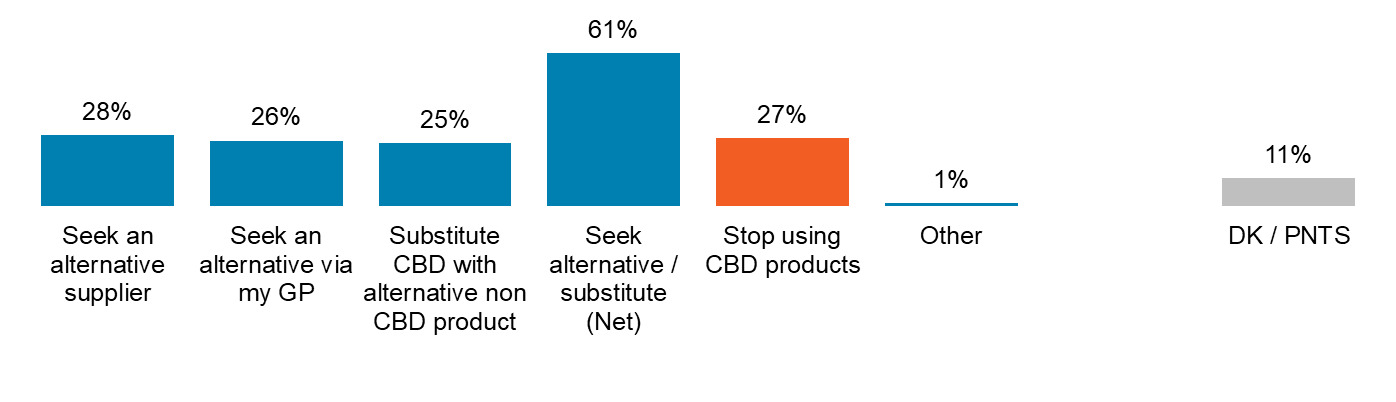

If they were no longer for sale in the UK, a quarter of users (27%) say they would stop using CBD products, while 61% would look for an alternative / substitute. Those who feel reliant on CBD are more likely to say they would seek alternatives (79%).

-

Trust in retailer / brand, value for money, product strength (all 91% very / fairly important) and price (88%) are the most important factors for users when making decisions about buying CBD products. People who feel reliant on CBD are significantly more likely than average to say social media recommendations (71% vs 51% overall) and celebrity endorsements (58% vs 38% overall) are important to them.

-

Health food shops and supermarkets (both 45%) are the most widely used outlets for buying CBD products. People who feel reliant are much more likely than those who do not feel reliant to say they typically buy CBD products from a pharmacy (51% vs 15%), online health food shops (27% vs 8%) and social media platforms (12% vs 3%).

-

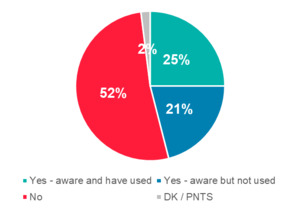

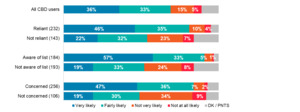

Before taking the survey, a minority of users were aware that CBD products have not been authorised for use for food and food supplements in the UK (42% aware); and that the FSA published a list of products being considered for authorisation (45% aware – with 25% saying they have used the list). Awareness was greater among those who feel reliant on CBD.

-

Interest in using the list of products being considered for authorisation was high among CBD users (70% said they were very or fairly likely to use this in the future), while around two-thirds (63%) are very or fairly concerned about consuming CBD products that are not authorised for use in foods and food supplements.

-

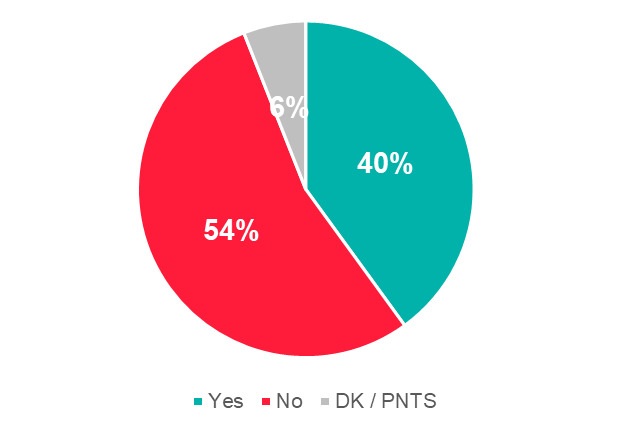

Just over half of users (54%) are unaware that the FSA advises a daily limit of 10mg of CBD for food and food supplements for healthy adults, with 40% aware of this recommendation.

-

A large majority aware of the advised daily intake limit say they always or sometimes follow this guidance (94%).

2. Introduction

Cannabidiol (CBD) is one of many chemicals called cannabinoids. It is found within hemp and cannabis plants and can be produced synthetically. CBD products are being sold as foods, often as food supplements, in the UK. They are widely available in shops, cafés and online, with CBD products being increasingly marketed through celebrity endorsements and on social media.

The Food Standards Agency (FSA) have published a list of CBD food products to help consumers make informed choices about the products they buy. However, products on this list are not formally authorised for sale and have not been fully assessed for safety.

The FSA commissioned Ipsos UK to conduct an online survey of CBD users to better understand:

-

Reasons for taking/consuming CBD

-

If consumers feel reliant on CBD products

-

The factors that influence CBD product purchasing decisions

-

Awareness of the regulatory issues related to CBD products

-

What consumers would do if CBD was withdrawn from the market

3. Material and methods

Ipsos UK interviewed a sample of 384 adults aged 18-75 in England, Wales and Northern Ireland who have used or consumed CBD products in the last 12 months. The sample was screened from a nationally representative starting sample of 1,968 adults aged 18-75 across the three nations. Interviews were conducted online through an Ipsos Omnibus survey. Fieldwork ran from 22 to 26 August 2025.

Quotas for the pre-screened sample were set on age within gender, region and working status to ensure a broad representation of groups. Final data for the pre-screened sample were then weighted by age within gender, region, social grade, working status within gender and education level using estimates from the ONS Annual Population Survey and RAJAR data (for social grade).

An overview of the final sample is provided in Appendix A and the survey questions are provided in Appendix B.

Only demographic differences that are statistically significant at the 95% confidence level, 2-tailed, have been commented on in this report.

4. Results

4.1. CBD Usage and Reliance

As shown in Figure 1, young adults and people from minority backgrounds report being more likely to use CBD products. Usage is much lower among older adults.

As shown in Figure 2, just over two in five users (44%) say they first consumed CBD products in the past year, with a third reporting they did so more than two years ago

Among younger users (those aged 18-34), half (52%) say they first consumed CBD in the last year. Users who say they are not reliant on CBD are more likely to say they first used CBD more than two years ago (41%), compared with users who are reliant (29%).

As shown in Figure 3, the most common reasons for using CBD are to support general wellbeing, manage mental health conditions, and as a sleep aid.

Pain relief and managing physical health conditions are less widely cited reasons – though people who say they are reliant on CBD products are likelier to mention these. Longer term users are likelier to consume CBD as a sleep aid.

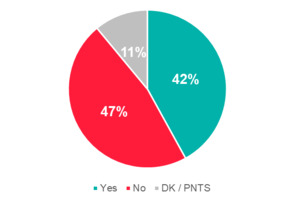

As shown in Figure 4, most users feel reliant on CBD products (59%) – with a quarter (28%) very reliant. People using CBD for pain relief (68%) and to manage physical health (78%) conditions, as well as those who would seek an alternative/substitute if no longer available (76%) are more likely to say they feel reliant.

Feelings of reliance on CBD products are also higher among demographic groups where usage is higher (e.g. 18-34s, ethnic minorities, males).

As shown in Figure 5, if CBD products were no longer for sale in the UK, three in five users (61%) say they would seek some form of substitute/alternative.

Twice as many users who feel reliant say they would seek an alternative/substitute (79%) compared with those who do not feel reliant (37%). In contrast, users who are not reliant are more likely to say they would stop using CBD products (44%) – or that they don’t know / prefer not to say what action they would take (17%).

4.2. Consumption and Purchasing Behaviours

A shown in Figure 6, consumers use CBD in different ways with drinks and oils most popular overall, but oils used slightly less frequently.

Health food shops (45%) and supermarkets (45%) are the most widely used places for typically buying CBD products. Around a third (36%) typically purchase CBD products from a pharmacy.

In addition to health food shops, supermarkets and pharmacies 27% bought CBD products from online CBD stores, 9% from social media platforms, and 5% from other types of stores. Those who reported being reliant were more likely to purchase CBD from a pharmacy, online health food shops, and social media platforms.

As shown in Figure 7, trust in retailer or brand, value for money, product strength and price are key factors when making decisions about buying CBD products.

As shown in Figure 8, users who said they feel reliant on CBD products are much more likely to say recommendations from social media and celebrity endorsements are important factors when making decisions about buying CBD products than those who reported they were not reliant.

4.3. Regulation

A minority of users are aware of the regulatory status of CBD products. 42% are aware that CBD products have not been authorised for use in food and food supplements in the UK (Figure 9) and 45% are aware of the FSA list of products that are being considered for authorisation (with 25% saying they have used this list) (Figure 10).

Awareness is greater among those who feel reliant on CBD (53% for products not being authorised; 61% for the list of products being considered for authorisation – with 34% having used this list).

As shown in Figure 11, around two thirds of CBD users (63%) are concerned about consuming unauthorised CBD products – concern is higher among users who feel reliant (72%).

As shown in Figure 12, likelihood to use the list of products being considered for authorisation is much greater among users who are already aware of the list (90%), concerned about consuming unauthorised products (83%) and who feel reliant (81%).

As shown in Figure 13, Just over half of CBD users are unaware that the FSA advises a daily limit of 10mg of CBD food and food supplements for healthy adults (54%), with 40% aware.

Awareness is twice as high among users who feel reliant on CBD products (50%) compared with users who do not feel reliant (24%).

Of those who are aware, two thirds (65%) say they always follow this limit, and three in ten (29%) that they sometimes follow the limit (Figure 14).

Acknowledgements

This report is based on an FSA commissioned survey run by Ipsos UK. The project code was FS900688.